By COLE REIF

Great Bend Post

As the collaborative effort to bring artificial turf to the ballfields at the Great Bend Sports Complex will get underway shortly, the City of Great Bend rehashed the initiative to stay on top of the turf upkeep and future quality of life projects and renovations.

At a study session Monday, the Great Bend City Council was mostly in favor of adding a sales tax for quality of life projects such as saving for turf replacement, basketball courts at Brit Spaugh Park, Cavanaugh soccer field enhancements, Heizer Park upgrades and hike and bike trail improvements, just to name a few.

City Administrator Kendal

Francis noted a revenue system, like a sales tax, is needed if Great Bend wants

to add amenities and keep their current facilities nice.

"If we want to build and remodel buildings, we're going to need some funds to take care of those and maintenance on the existing buildign we have," said Francis. "That has been an issue historically here and that is why we're needing to build new buildings."

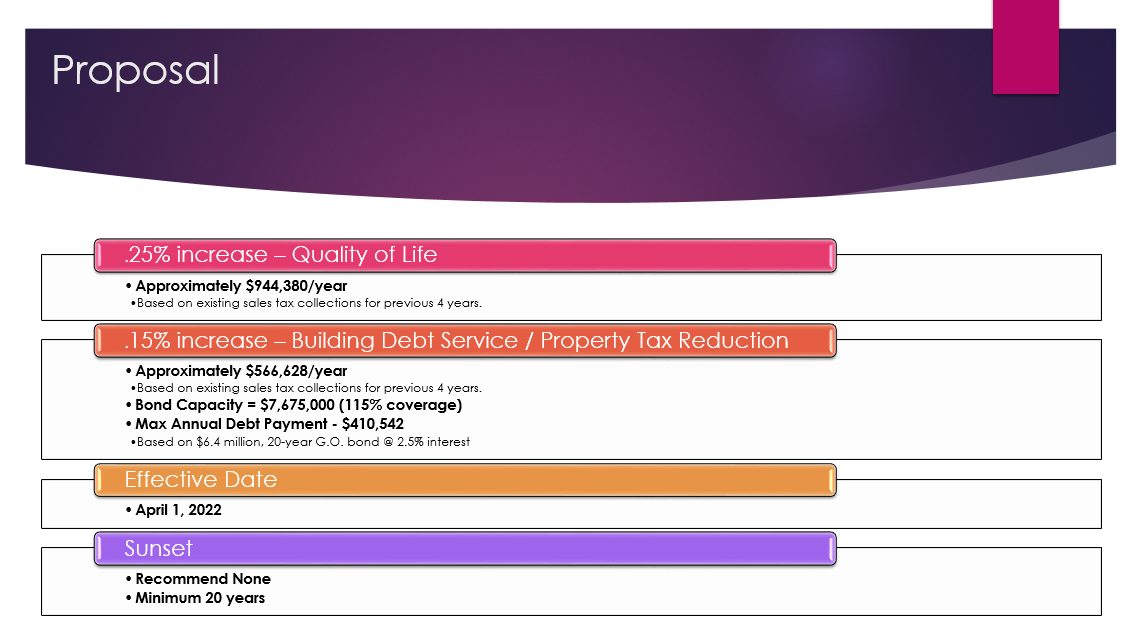

The recommendation is to add a .25% increase to the sales tax for quality of life

projects, which would generate approximately $944,000 per year.

Great Bend is

also in the process of seeking bids to construct a new police station at the

intersection of 12th & Baker to replace their aging structure on

Williams Street that was built in 1928. Francis proposed an additional .15%

sales tax increase to go towards building debt service that would help pay off

bonds. This would go towards paying for the roughly 25,000-square-foot police

station, renovating the rest of the Great Bend Events Center to relocate City Hall to and

future renovations and construction.

"If we were to move forward with a sales tax initiative on the November ballot and it failed, my recommendation would be to hold a special election to solely ask for a .1% sales tax to pay debt service for the police station only," said Francis.

The .15% increase would generate approximately $566,000 per year.

Great Bend anticipates the new police station construction will cost $5.5 million. Relocating City Hall offices to the Events Center is expected to cost $2.4 million in renovations to the rest of the back offices of the facility on 10th Street. The city currently has $1.5 million in savings for such projects and would need to finance $6.4 million to complete both projects.

The city council will formally vote on the sales tax resolution at least 90

days before the election. If approved, the tax increase question will be voted

on in the November General Election. If citizens vote in favor of the increase,

the bump would go into effect April 1, 2022.

Francis recommended no sunset on the sales tax increase, but a couple of councilmembers suggested setting a 20-year limit with discussion of extending the tax as the expiration came closer.

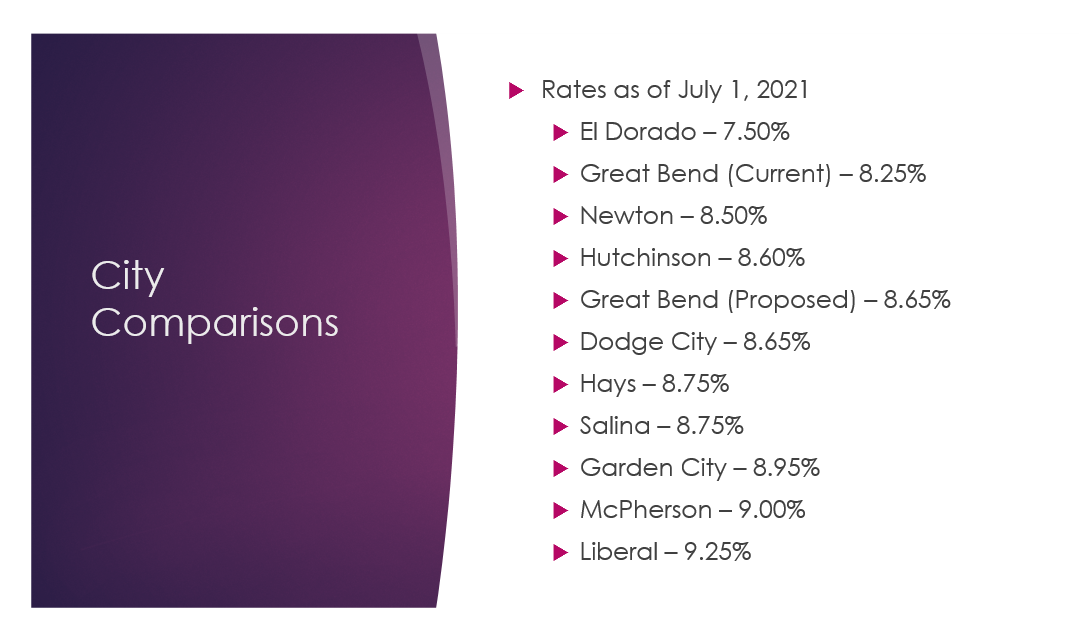

Great Bend’s current sales tax is at 8.25%. The total .4% increase would take the tax to 8.65%, still lower than Hays, Salina, Garden City, McPherson and Liberal.

Listen below to the entire discussion from the study session June 21, 2021 regarding sales tax.