By DALE HOGG

Barton County Media Consultant

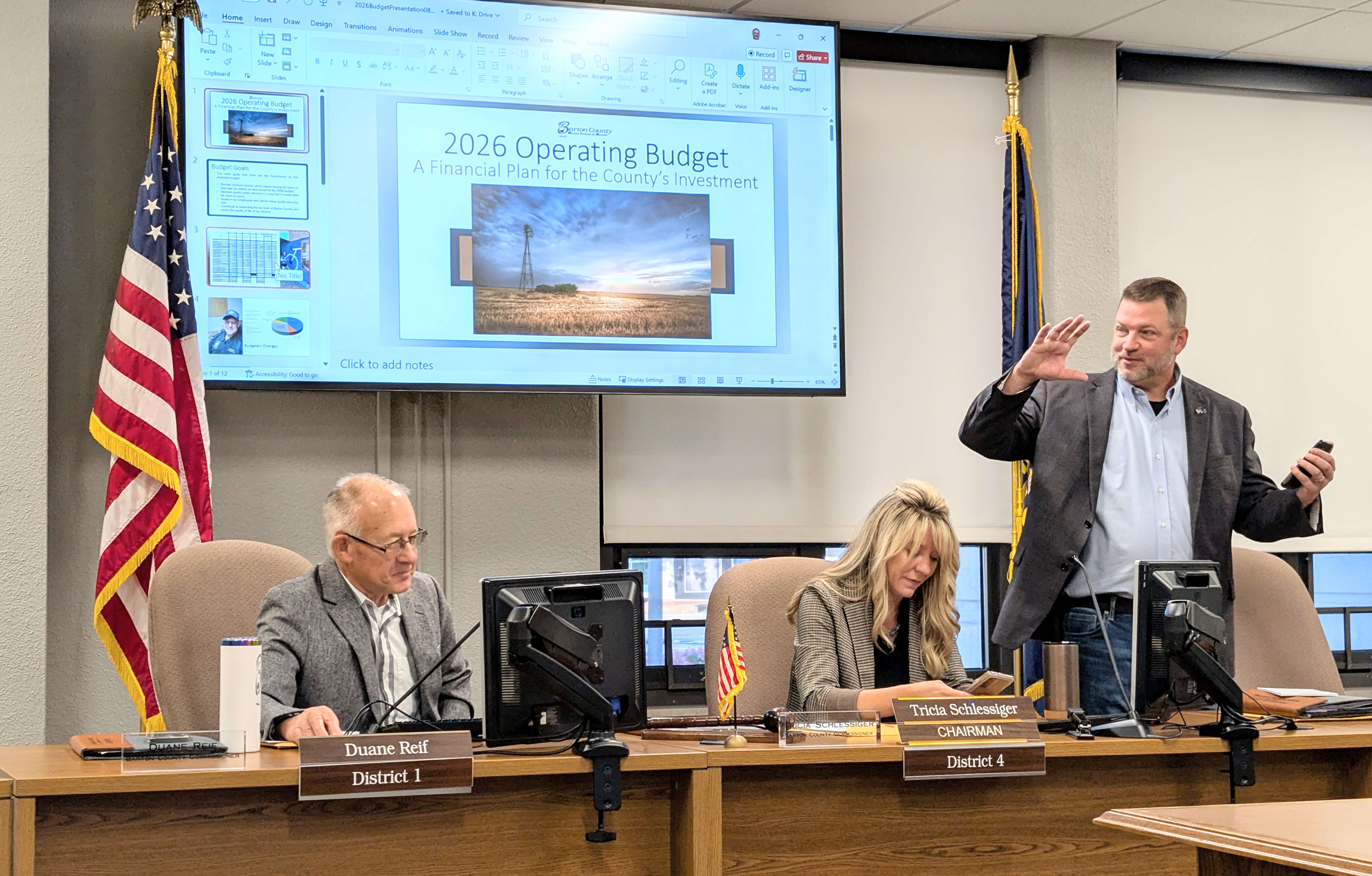

Culminating a months-long process of review and public input and following a public hearing, the Barton County Commission Tuesday morning formally adopted its 2026 operating budget that, for the fifth year in a row, stayed under the state-mandated revenue-neutral rate.

The budget, which was published in the Great Bend Tribune on Aug. 9, calls for a mill levy of 33.921, a reduction of 1.898 mills from the previous year. This rate is slightly below the county’s revenue-neutral rate of 33.925.

“Every budget year is unique and presents its own challenges,” County Administrator Matt Patzner said in his 2026 budget message to the commission. “This year was no different as the commissioners had to find a way to accomplish all of these goals with continuing rising costs for commodities, services and quality personnel with fewer Ad Valorem tax dollars than the year before.”

“I would just also want to thank you for all your hard work on this,” District 5 Commissioner Donna Zimmerman said. “I know, as we've stayed under the revenue-neutral rate, and things have been slimmer to fund, harder to fund, and that makes the budget even more difficult.”

The new budget will generate a total of $11,941,414 in ad valorem tax dollars, which is $18,407 less than the amount generated for the 2025 budget. One mill represents one dollar of tax for every $1,000 of a property's assessed value.

Patzner said the budget's primary goals were to remain revenue-neutral, maintain quality public services, invest in county employees and contribute to the expansion of the tax base.

The RNR dates back to the Kansas Legislature's 2021 Truth in Taxation Act. It is the mill levy rate that allows a taxing entity to collect the same amount of property tax revenue as the previous year, accounting for changes in a county's total assessed property valuation. If an entity plans to exceed that rate, it must hold a hearing.

The overall budget authority for all funds is up by $820,305 from 2025. This increase is primarily due to rising personnel and insurance costs, as well as increased funding for road and bridge maintenance, community development and outside agencies. Patzner said the county was able to absorb the increase by beginning the year with a higher cash carryforward and increased revenue from sources other than ad valorem tax, such as sales tax and departmental revenue.

Ad valorem tax makes up less than half of the total revenue needed for the county’s balanced budget. Other major funding sources include cash carryforward, motor vehicle tax, sales and use tax, and various fees and grants.

“The percentage of funding needed from Ad Valorem tax revenue for a balanced budget is down 2% compared to 2025’s budget,” he said. “As with all budgets, the goal is to maintain quality public services while trying to keep this Ad Valorem Tax number as small as possible to be good stewards of the taxpayer’s money.”

The property tax dollars are distributed to taxing entities throughout the county, Patzner said. “Depending on where you live, only 18-22% of your property tax dollars support Barton County government.”

Over the past five years, Patzner said the mill rate has decreased over 12 mills and there has been a $284,000 decrease in the total tax dollars collected. And, this may be the first time that property taxes made up less than half (coming in at 49%) of the county’s spending package.

“That really illustrates that we are controlling what we can control,” he said. This is their goal every year going into the budgeting process.

“This has been one of the best experiences of my life,” District 3 Commissioner Shawn Hutchinson said of his time working on budgets while on the board. “We really are here to serve you, and what we're trying to do is grow our tax base so that everybody's piece of the pie is a little bit smaller.”

“As future budget years present themselves, they will bring with them unique challenges. I believe that with adequate cash reserves, zero debt, and careful planning, the county can address these challenges in a sustainable way as they come forward,” Patzner said. “With the leadership of the County Commissioners, the diligence and care of our department heads, and the high quality of our employees, Barton County remains fiscally sound and is in the position to maintain a sustainable mill levy for years to come while contributing to the expansion of our tax base and continuing to provide quality public services.”

“We couldn't do this, the five of us, without everybody else that works for the county,” said Commission Chairperson Tricia Schlessiger, District 4.

“Every day we ask them to lean up and do more with less, with rising costs, and to have a decreasing budget. That is pretty phenomenal.”

The county has cut 11 positions over the past five years. But, this year’s budget includes a 50-cent raise for all employees.

With the adoption finalized, the budget will now be delivered to the County Clerk’s Office to meet statutory deadlines.