By MIKE COURSON

Great Bend Post

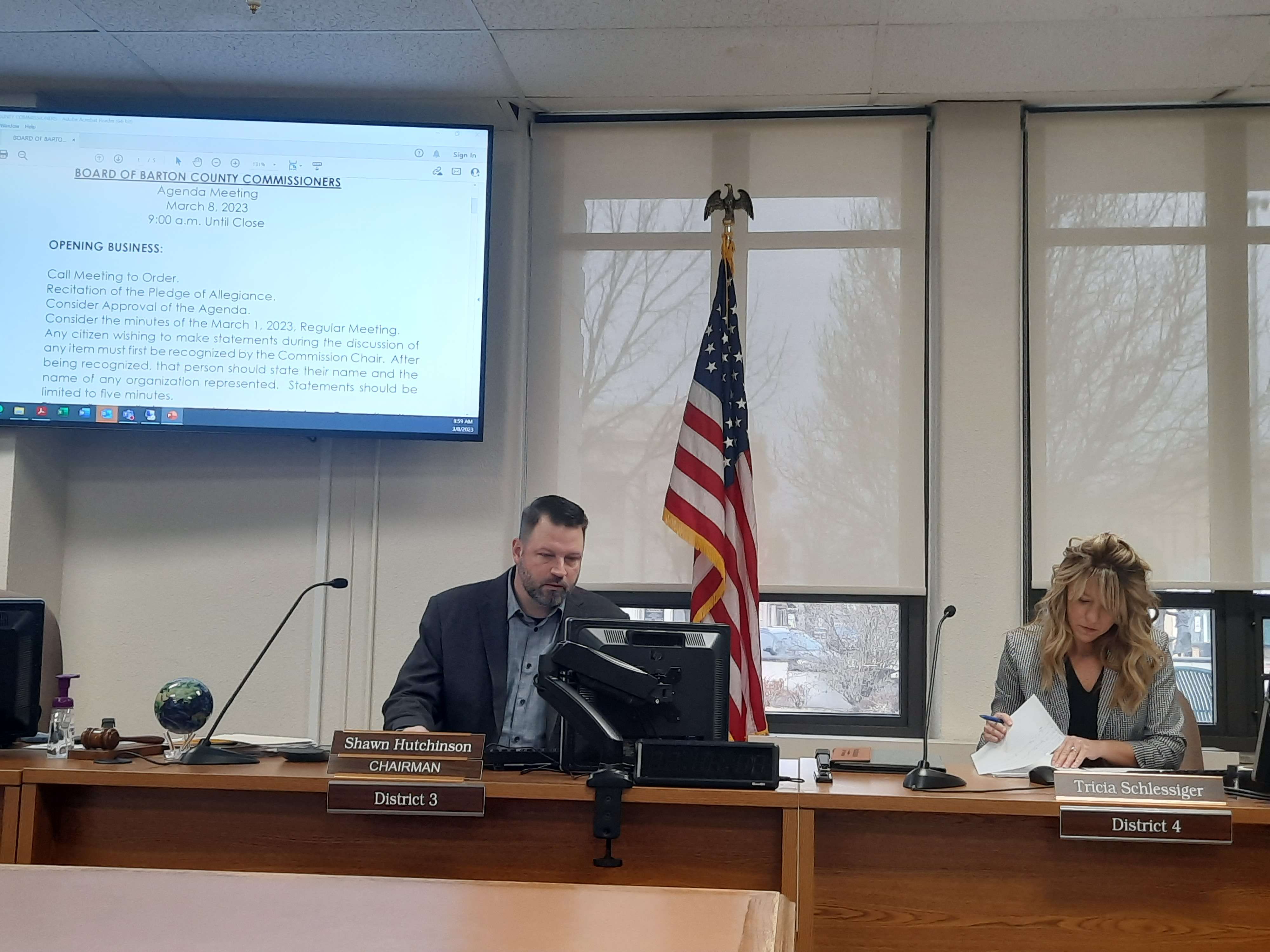

There's no such thing as a bad idea. Commission Chair Shawn Hutchinson dropped a big one at the close of Wednesday's Barton County Commission meeting. The idea revolves around shifting some local tax collection from property taxes to sales tax.

"I don't know if there's anything to announce at this time, but I was just going to say this commission has been working hard to try to figure out a new type of tax plan," he said. "We're going to give it to the state when we get it done, but we're going to try and just do our own thing if we can. Hopefully, we can set a precedent for the rest of the state."

County Administrator Matt Patzner approached Hutchinson and Commissioner Barb Esfeld with the idea. He said the county is currently responsible for one percent of the sales tax, but only collects 40-43 percent of that tax, which is distributed to communities in the county. An increased sales tax would shift the burden of who is paying taxes.

"Obviously, if you live here you're going to be paying sales tax, but you also have people from other communities paying sales tax," Patzner said. "If county government was allowed to do that, we would be shifting from property tax to sales tax, which I think generally, is a more accepted, more fair taxing process. It was just an idea of an idea at this point, but it got some discussion going and we're going to see where it goes."

Esfeld recently attended a legislative in Topeka and introduced the idea in front of one of the state's attorneys. "I will tell you, I thought I spoke a different language because their jaws just dropped," she said. "Nobody said anything for a long time." A commissioner from another county said if Barton County can do it, they want to do it.

The idea is only in its infancy so no timetable or figures were discussed at Wednesday's meeting. The commission was unsure if such a move would even be legal under current state law.

"We have discussed, what would it look like if the county can put it out to the voters for a cent sales tax increase that would all go to property tax," said Esfeld. "I wanted to know if that was legal. Could we do that? Could we put that to our voters?"

Esfeld said cities can currently raise sales taxes three cents, but counties are allowed only a one-cent increase. Hutchinson said the county currently operates on a $12 million levied-fund budget. Bringing in, for example, $4 million in additional sales tax would mean operating on an $8 million budget levied from property taxes.

A sales tax increase could mean more tax collection on residents who do not own property, but would also mean additional revenue from those who do not pay income tax, and especially from consumers who buy in Barton County but live outside the county.